So I was thinking about how folks in the Solana ecosystem juggle their crypto assets these days. Honestly, the whole staking and yield farming buzz feels kinda like a wild west ride—thrilling but also a bit sketchy if you don’t know your stuff. Wow! The rewards can look crazy tempting, but there’s a catch or two lurking beneath the surface. The more I dug, the more I realized it’s not just about locking up tokens and watching your balance grow. Nope, there’s this whole dance with security, usability, and hardware wallets that most people overlook.

Initially, I thought staking was just about putting your SOL in a validator and chilling while the rewards roll in. But then I realized, wait—there’s a ton more nuance here. For example, how do you actually keep your tokens safe while interacting with DeFi protocols? And where do hardware wallets fit into all this? On one hand, staking feels straightforward, though actually, when you start mixing yield farming strategies, things get complicated fast.

Here’s the thing. If you’re like me and want to dabble in staking without risking your entire wallet’s security, you gotta think beyond just software wallets. Hardware wallets offer a neat layer of protection by keeping your private keys offline. But integrating them with Solana’s fast-moving DeFi apps? That’s a whole different story. The user experience can be rough, and sometimes it doesn’t feel very seamless.

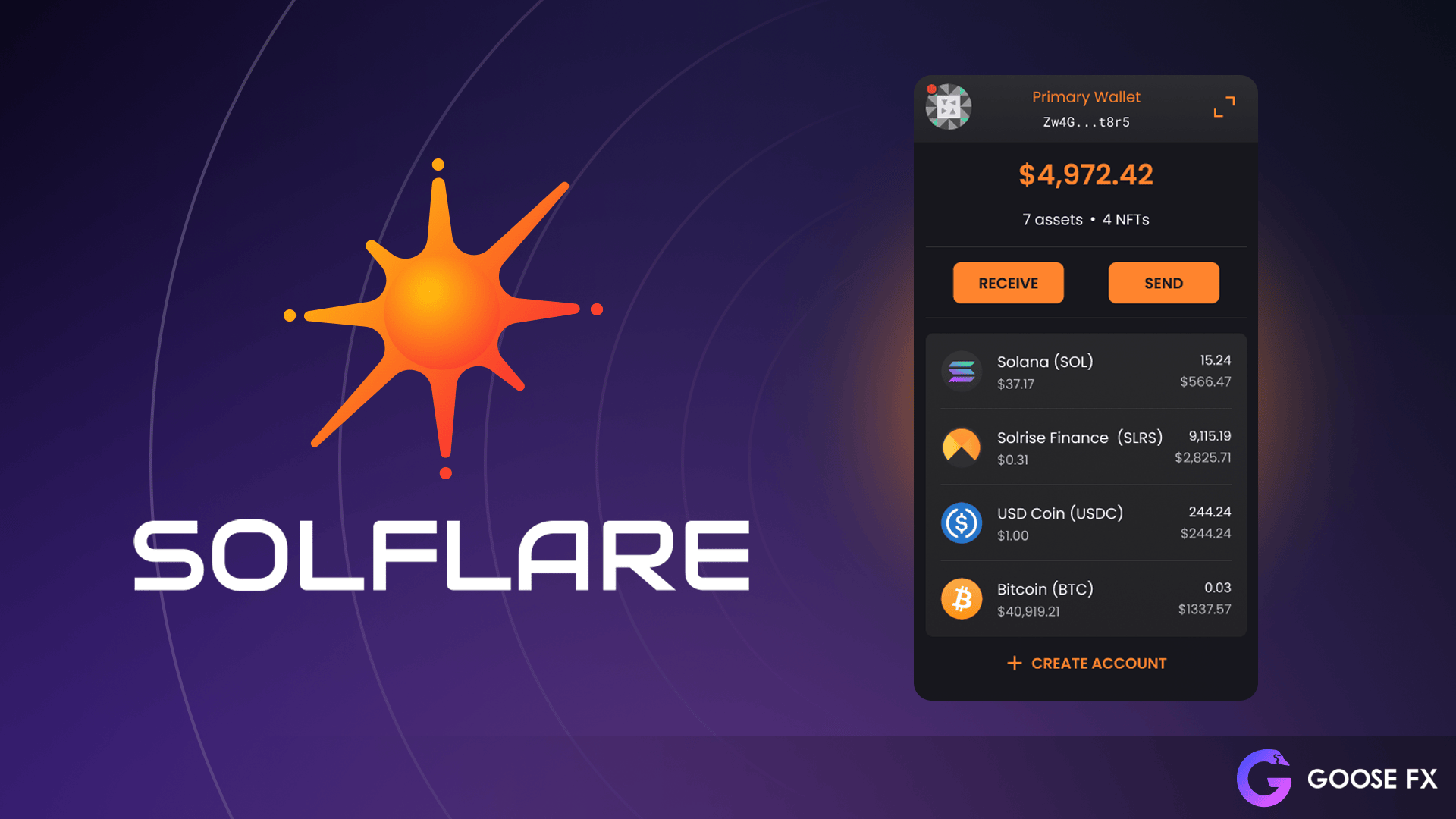

Check this out—there’s a wallet called Solflare that’s been making strides in this space. It’s been around for a while, gaining traction specifically with Solana users. The thing I like about Solflare is its balance of ease and security. If you want to get your hands dirty with staking or yield farming, using a trusted wallet that supports hardware integrations is super important. If you haven’t yet, you might want to try the solflare download to see what I mean.

Really? Yeah, and the good news is that wallets like Solflare have been improving their hardware wallet support steadily, which means you can stake SOL and also dive into yield farming protocols without exposing your keys to unnecessary risk. But, I’ll be honest—sometimes the setup can be a little finicky, especially for newbies. The documentation is decent but not perfect. You might have to troubleshoot a bit or search forums to get everything running smoothly.

Yield farming on Solana feels like a double-edged sword. On one side, the yields are attractive given Solana’s low fees and high throughput. On the flip, the ecosystem’s rapid growth means some projects aren’t battle-tested, which raises red flags. Hmm… I remember trying a yield farm last fall that promised crazy APYs. Turned out it was a short-lived hype. Luckily, my hardware wallet kept my main stash safe, so losses were minimal. That experience made me value hardware wallet integration even more.

The stakes get higher when you want to compound rewards or move tokens between protocols. Every transaction ups your exposure to phishing or smart contract bugs. Even though Solana’s blockchain is fast, that speed sometimes lulls users into a false sense of security. You might overlook a suspicious link or approve a transaction too quickly. My instinct says—take your time and verify everything, especially with yield farming where contracts can be complex.

Oh, and by the way, staking rewards on Solana aren’t just passive income; they’re also part of securing the network. Delegating your SOL to a good validator helps keep the chain healthy, but picking the right validator isn’t always obvious. There’s a lot of chatter about validator performance, commission rates, and decentralization. If you’re new, it’s easy to get overwhelmed and just pick the first one you see, but that might not be the best move.

One thing that bugs me is how wallet interfaces sometimes hide important details about validators or farming pools. Transparency is crucial, yet some apps make it hard to compare options side-by-side. For instance, you want to know the validator’s uptime, historical rewards, and whether they’ve had any slashing incidents. Solflare does a decent job showing this info, but honestly, it could be clearer.

Hardware Wallets and Their Growing Role in DeFi

Okay, so check this out—hardware wallets aren’t just for hodling anymore. They’re increasingly essential for engaging with DeFi on Solana safely. Why? Because they keep your private keys in a physical device, disconnected from the internet, minimizing the risk of hacks. That’s huge when you’re interacting with yield farms or staking pools that require multiple wallet approvals.

But here’s the rub: integrating hardware wallets with DeFi apps on Solana isn’t always plug-and-play. Sometimes the wallet’s firmware needs updates, or the app’s support lags behind new Solana features. That mismatch can cause delays or failed transactions. I ran into that recently when trying to stake through a new protocol. It was frustrating, but I learned to keep my hardware wallet’s software updated and double-check compatibility before jumping in.

Also, not all hardware wallets support Solana natively yet. Ledger and Trezor have made progress, but you’ll want to ensure your chosen wallet works smoothly with your staking or farming platform. That’s where wallets like Solflare acting as a bridge come in handy. They support hardware wallet connections and provide a user-friendly interface to manage your staking rewards and yield farming positions.

Something felt off about some early hardware wallet integrations—they were clunky and slow, which kinda defeated the purpose of fast Solana transactions. But the newer versions have improved significantly. The experience now feels more natural, though sometimes you still have to confirm multiple steps on the device, which can slow you down. I guess that’s the trade-off between security and convenience.

For anyone serious about scaling their Solana DeFi game, investing in a hardware wallet and pairing it with a solid app like Solflare is very very important. Sure, it’s an extra step compared to just using a browser wallet, but the peace of mind is worth it. Plus, as the ecosystem matures, I expect these integrations to get smoother and more intuitive.

Here’s another thought—staking rewards themselves can be reinvested automatically in some yield farming setups, but that requires trust in smart contracts. It’s tempting to just let your rewards compound hands-free, but honestly, that makes me nervous. I prefer to claim and review my rewards regularly before redeploying them. Call me old-fashioned, but I like knowing exactly where my tokens are and what risks I’m taking.

Honestly, if you’re dipping your toes into Solana’s staking and yield farming, give yourself some grace. The ecosystem moves fast, and sometimes the interfaces or protocols feel half-baked. But wallets like Solflare, especially with their hardware wallet support, are solid companions on this journey. If you want to experiment without losing sleep, start there. Don’t just download any wallet—try the solflare download and get a feel for their setup and security features.

There’s still a lot we don’t know about how staking rewards and yield farming will evolve on Solana. New protocols pop up daily, and some may not last. That uncertainty keeps me on my toes. On the bright side, it also means there’s opportunity for those willing to do their homework and secure their assets properly.

Common Questions About Staking and Hardware Wallets on Solana

Is staking on Solana safe?

Staking on Solana is generally safe if you choose reputable validators and secure your wallet properly. Using hardware wallets adds extra security by keeping your keys offline.

Can I use hardware wallets for yield farming?

Yes, but integration can vary between wallets and protocols. Wallets like Solflare support hardware wallet connections that help manage yield farming securely.

How do I pick a good validator?

Look for validators with high uptime, low commission fees, and good community reputation. Tools within wallets like Solflare can help you compare them.

What’s the difference between staking rewards and yield farming?

Staking rewards come from helping secure the network by delegating tokens, while yield farming involves providing liquidity or participating in DeFi pools to earn additional returns.

0 komentářů